Essex County (New Jersey) property taxes rank among the highest statewide, averaging about 2.436%, or roughly $13,737 annually on a median-priced home. Rates differ widely between municipalities due to school, county, and local budget demands, making accurate estimates essential. Our Essex County property tax calculator helps homeowners compare town-level variations, understand tax components, and plan smarter finances while navigating bill differences that can vary by nearly $15,000 across the county.

Essex County Tax Estimator (2024 Rates)

Estimator uses 2024 Essex County effective tax rates (rate per $100 of assessed value).

Essex County (New Jersey) Property Tax Due Dates 2026

Essex County property taxes are paid quarterly to help homeowners manage annual bills. Payments follow a fixed schedule across municipalities, and using your Essex County property tax calculator helps you plan accurate, on-time payments.

| Quarter | Due Date (2026) | Grace Period | Notes |

|---|---|---|---|

| Q1 | February 1, 2026 | 10 Days | Interest starts after grace period |

| Q2 | May 1, 2026 | 10 Days | Weekend/holiday extends to next business day |

| Q3 | August 1, 2026 | 10 Days | Postmarks not accepted as proof |

| Q4 | November 1, 2026 | 10 Days | Pay online, mail, or municipal office |

Essex County Property Tax Penalties & Late Payment Rules

If Essex County property taxes remain unpaid after the 10-day grace period, interest begins accruing from the 11th day. Continued delinquency may result in municipal tax liens or foreclosure proceedings. Because New Jersey does not accept postmarks as proof of timely payment, homeowners must ensure payments are received before deadlines.

How Our Essex County (New Jersey) Property Tax Calculator Works

Our Essex County property tax calculator estimates annual taxes using local effective rates, assessed values, and credits. Enter property details to preview realistic tax bills before reviewing official municipal assessments.

Enter Property Details & Local Factors

Start by entering your Essex County property’s market value, selecting the correct municipality, and choosing property type such as residential or commercial. The calculator applies local effective tax rates and optional owner-occupancy credits to reflect realistic local tax structures used across different towns and school districts within the county today.

Understanding Assessed Value in Essex County

After entering details, the Essex County property tax calculator estimates assessed value, typically a percentage of true market value set by local assessors. Taxes are calculated by multiplying assessed value with the municipality’s effective tax rate, which combines county, school, and municipal levies that fund essential public services locally today.

Example: Essex County Property Tax Calculation Process

Example: A $400,000 residential home in Belleville with an estimated assessed value of $360,000 and a 2.436% effective tax rate would generate an annual tax estimate near $8,770 before credits. Applying a 2% owner-occupancy credit slightly reduces the projected bill, helping homeowners compare scenarios and understand potential payment differences clearly.

Essex County (New Jersey) General Property Tax Rate Breakdown by Municipality(Payable in 2026)

Understanding Essex County’s general tax rate structure helps homeowners compare municipal costs, school taxes, and county charges. Each town combines multiple components to form total property tax obligations. The following tables organize complete 2026 taxing district data to help you analyze effective tax rates and local tax distribution differences.

Essex County Tax Districts 01–07 Overview

These Essex County municipalities show how county taxes, school taxes, and municipal purpose taxes combine into a general tax rate. Use this data to compare effective rates and understand localized property tax structures across smaller townships.

| Taxing District | County | Open Space | School | Regional | Municipal | Gen Rate | Eff Rate |

|---|---|---|---|---|---|---|---|

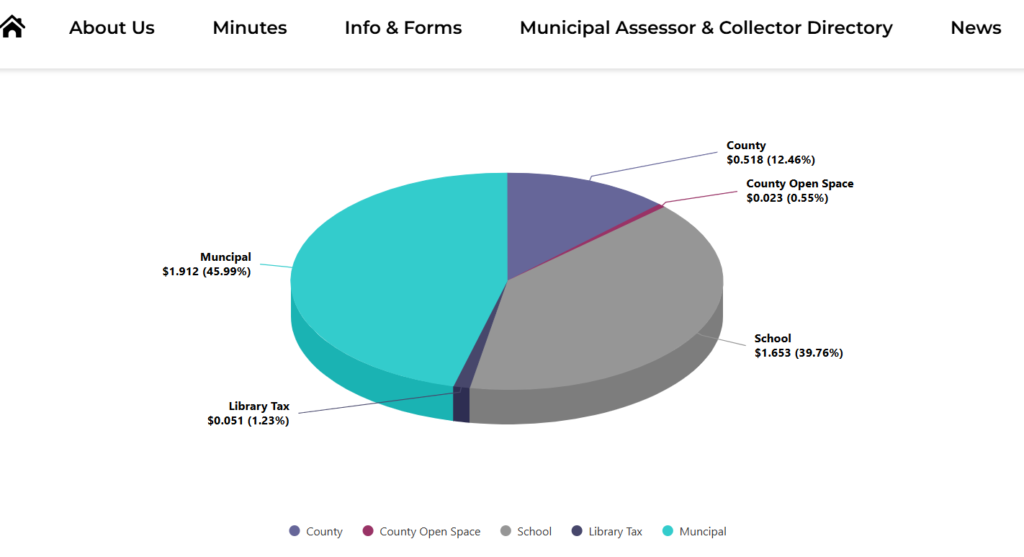

| Belleville Twp | 0.518 | 0.023 | 1.653 | 0.000 | 1.912 | 4.157 | 2.710 |

| Bloomfield Twp | 0.494 | 0.022 | 1.589 | 0.000 | 1.331 | 3.489 | 2.391 |

| Caldwell Twp | 0.489 | 0.022 | 0.000 | 1.682 | 1.007 | 3.257 | 2.254 |

| Cedar Grove Twp | 0.453 | 0.020 | 1.547 | 0.000 | 0.539 | 2.603 | 1.943 |

| East Orange City | 0.379 | 0.017 | 0.847 | 0.000 | 1.951 | 3.241 | 2.886 |

| Essex Fells Twp | 0.415 | 0.019 | 0.795 | 0.441 | 0.641 | 2.311 | 1.885 |

| Fairfield Twp | 0.425 | 0.019 | 0.466 | 0.590 | 0.529 | 2.081 | 1.645 |

Essex County Tax Districts 08–15 Overview

Mid-county municipalities reflect a range of school and municipal funding structures. Reviewing effective tax rates helps homeowners evaluate how regional school districts and local budgets influence final annual property tax bills.

| Taxing District | County | Open Space | School | Regional | Municipal | Gen Rate | Eff Rate |

|---|---|---|---|---|---|---|---|

| Glen Ridge | 0.526 | 0.023 | 2.136 | 0.000 | 0.771 | 3.508 | 2.257 |

| Irvington Twp | 0.300 | 0.014 | 0.356 | 0.000 | 1.820 | 2.587 | 2.913 |

| Livingston Twp | 0.452 | 0.020 | 1.542 | 0.000 | 0.452 | 2.531 | 1.882 |

| Maplewood Twp | 0.333 | 0.015 | 0.000 | 1.356 | 0.654 | 2.401 | 2.434 |

| Millburn Twp | 0.434 | 0.019 | 1.033 | 0.000 | 0.480 | 2.019 | 1.571 |

| Montclair Twp | 0.551 | 0.025 | 1.911 | 0.000 | 0.868 | 3.516 | 2.160 |

| Newark City | 0.486 | 0.032 | 1.106 | 0.000 | 2.218 | 3.999 | 1.845 |

| North Caldwell Twp | 0.442 | 0.020 | 0.826 | 0.592 | 0.413 | 2.308 | 1.769 |

Essex County Tax Districts 16–22 Overview

These municipalities highlight higher municipal purpose taxes and varying effective tax rates. Comparing these districts helps homeowners understand how local budgets and school funding structures impact overall Essex County property tax responsibilities.

| Taxing District | County | Open Space | School | Regional | Municipal | Gen Rate | Eff Rate |

|---|---|---|---|---|---|---|---|

| Nutley Twp | 0.380 | 0.017 | 1.383 | 0.000 | 0.882 | 2.699 | 2.401 |

| Orange City | 0.363 | 0.016 | 0.599 | 0.000 | 2.986 | 4.030 | 3.765 |

| Roseland | 0.330 | 0.015 | 0.491 | 0.474 | 0.498 | 1.862 | 1.817 |

| South Orange Village | 0.354 | 0.016 | 0.000 | 1.481 | 0.688 | 2.584 | 2.469 |

| Verona Twp | 0.483 | 0.022 | 1.821 | 0.000 | 0.761 | 3.165 | 2.216 |

| West Caldwell Twp | 0.444 | 0.020 | 0.000 | 1.546 | 0.696 | 2.749 | 2.096 |

| West Orange Twp | 0.287 | 0.013 | 1.628 | 0.000 | 0.665 | 2.627 | 3.080 |

Download Essex County (New Jersey) General Property Tax Rate Breakdown PDF

This Essex County property tax rate breakdown PDF provides a complete overview of all municipal tax districts, including county, school, and municipal tax components with general and effective tax rates. Use this structured dataset to compare towns, analyze local tax burdens, and support accurate estimates when using your Essex County property tax calculator or planning future property expenses.

Conclusion

Essex County (New Jersey) property taxes vary widely by municipality, tax structure, and assessed value, making accurate estimates essential for homeowners and investors. Using a reliable Essex County property tax calculator helps you understand effective rates, payment deadlines, and local tax components. By reviewing district breakdowns, due dates, and calculation examples, you can better plan annual expenses, compare towns, and avoid penalties through timely, well-informed property tax payments.

FAQs

What is the average property tax rate in Essex County, NJ?

The average effective property tax rate in Essex County is around 2.436%, though actual rates vary significantly by municipality based on local school and municipal budgets.

When are Essex County property taxes due?

Property taxes are typically due quarterly on February 1, May 1, August 1, and November 1, with a standard 10-day grace period before penalties begin.

How does the Essex County property tax calculator work?

The calculator estimates taxes using market value, assessed value, municipality, property type, and available credits to generate realistic annual property tax projections.

What happens if I pay Essex County property taxes late?

Late payments incur interest starting after the grace period. Continued nonpayment may result in tax liens or foreclosure proceedings initiated by the municipality.

Why do property tax bills vary between Essex County towns?

Tax bills differ because each municipality has unique school funding needs, municipal budgets, and effective tax rates that combine county, school, and local taxes.