Hudson County (New Jersey) homeowners face some of the highest property taxes in the state, with an average effective rate of around 2.12% in 2025. Annual tax bills typically range between $9,300 and $9,500, varying by municipality. Cities like Jersey City, Weehawken, and Kearny experience higher rates, while relief programs such as the Stay NJ program offer seniors potential reimbursements. Our Hudson County property tax calculator helps residents estimate accurate tax bills efficiently.

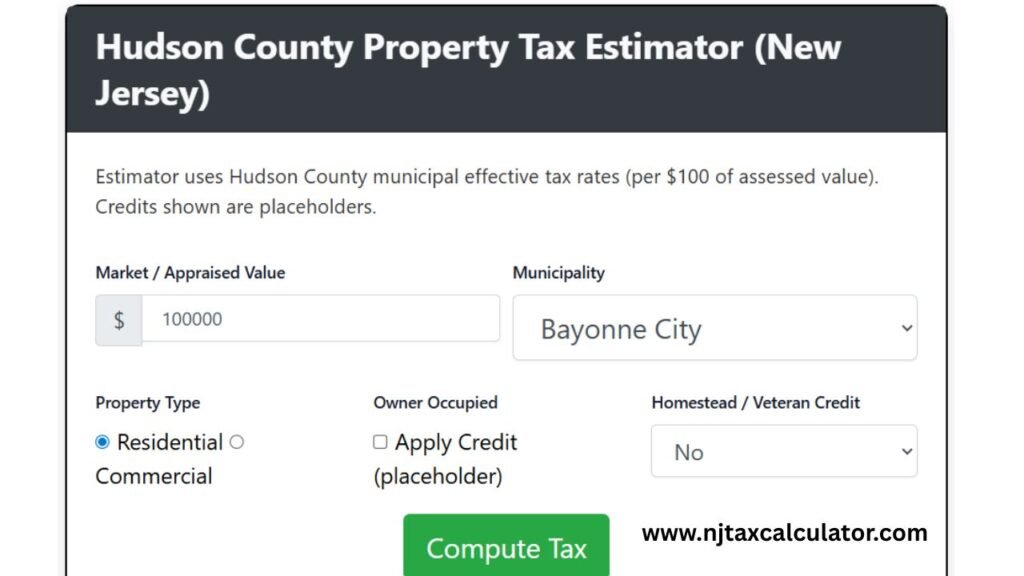

Hudson County Property Tax Estimator (New Jersey)

Estimator uses Hudson County municipal effective tax rates (per $100 of assessed value). Credits shown are placeholders.

Hudson County Property Tax Due Dates 2026

In Hudson County, New Jersey, property taxes are due quarterly on February 1, May 1, August 1, and November 1. Residents should plan ahead to avoid penalties and ensure timely payments.

| Quarter | Due Date |

|---|---|

| Q1 | February 1 |

| Q2 | May 1 |

| Q3 | August 1 |

| Q4 | November 1 |

Penalties for Late Property Tax Payments

If Hudson County property taxes are not paid by the 10th day of each due month, interest accrues from the original due date. Interest is 8% per annum on the first $1,500 and 18% on amounts over $1,500. Year-end penalties of 6% may apply on delinquencies exceeding $10,000, making timely payment essential to avoid extra charges.

Hudson County Property Tax Calculator

Our Hudson County property tax calculator helps residents estimate annual taxes quickly. Enter your property value, select municipality, and property type to see assessed value, tax rate, and estimated tax due accurately.

How to Use the Hudson County Tax Calculator

Simply enter your property’s market value and select the municipality (e.g., Jersey City, Weehawken). Choose the property type, such as residential or commercial, and indicate if you qualify for credits like owner-occupancy. The calculator then automatically computes your assessed value and estimated annual taxes based on the current Hudson County tax rates.

Understanding Assessed Value

Assessed value is the portion of your property’s market value used to calculate taxes. For example, a $300,000 home in Jersey City with a 100% assessment ratio would have an assessed value of $300,000. This figure is multiplied by the local tax rate to determine your annual property tax bill.

Applying Credits and Adjustments

If you qualify for the Owner-Occupancy Credit (2%) or the Homestead benefit, the calculator applies these reductions automatically. For instance, a residential property in Hudson County worth $250,000 could save hundreds annually if you claim eligible credits, lowering the effective property tax owed.

Hudson County 2024 Property Tax Rates (payable in 2026)

Property taxes in Hudson County vary by municipality, reflecting local budgets and property values. The following tables show general and effective tax rates across all districts, helping homeowners estimate annual obligations accurately. Rates include sub-county and municipal components for clarity.

General Tax Rates by District

Below are the 2024 general and effective tax rates for Hudson County municipalities. This table helps property owners understand how rates differ across cities and towns.

| District | General Tax Rate (%) | Effective Tax Rate (%) |

|---|---|---|

| Bayonne City | 2.796 | 2.116 |

| East Newark Boro | 2.963 | 1.683 |

| Guttenberg Town | 4.128 | 2.400 |

| Harrison Town | 2.346 | 1.864 |

Major City Tax Rates

The following table highlights rates for larger cities in Hudson County, showing how taxes impact residential and commercial properties differently.

| District | General Tax Rate (%) | Effective Tax Rate (%) |

|---|---|---|

| Hoboken City | 1.766 | 1.109 |

| Jersey City City | 2.233 | 1.919 |

| Kearny Town | 10.705 | 2.041 |

| North Bergen TWP | 1.747 | 1.670 |

Sub-County and Additional District Rates

This table includes smaller districts and sub-county rates, helping residents calculate property taxes including township and municipal levies.

| District | General Tax Rate (%) | Effective Tax Rate (%) |

|---|---|---|

| Secaucus Town | 4.092 | 2.027 |

| Union City City | 1.848 | 1.997 |

| Weehawken TWP | 1.956 | 1.873 |

| West New York Town | 8.259 | 1.862 |

Hudson County School and Local Purpose Taxes

Hudson County property owners also pay school, library, and other purpose-based taxes. These components contribute to the overall effective tax rate, helping residents understand where their tax dollars go.

| District | School Tax (%) | Library Tax (%) | Purposes Tax (%) | Effective School Tax Rate (%) |

|---|---|---|---|---|

| Bayonne City | 2.796 | — | — | 2.116 |

| East Newark Boro | 2.963 | — | — | 1.683 |

| Guttenberg Town | 4.128 | — | — | 2.400 |

| Harrison Town | 2.346 | — | — | 1.864 |

| Hoboken City | 1.766 | — | — | 1.109 |

| Jersey City City | 2.233 | — | — | 1.919 |

| Kearny Town | 10.705 | — | — | 2.041 |

| North Bergen TWP | 1.747 | — | — | 1.670 |

| Secaucus Town | 4.092 | — | — | 2.027 |

| Union City City | 1.848 | — | — | 1.997 |

| Weehawken TWP | 1.956 | — | — | 1.873 |

| West New York Town | 8.259 | — | — | 1.862 |

Note: Library and Purposes Tax may vary or be included in the general municipal tax; effective school tax rate reflects the portion contributing to education.

Hudson County 2024 Property Tax Rates PDF

Download the comprehensive Hudson County 2024 property tax rates PDF, covering general, effective, school, library, and purposes taxes for all municipalities. This resource helps homeowners and investors quickly access accurate tax data for planning and budgeting purposes.

Conclusion

Hudson County property taxes vary significantly by municipality, reflecting local budgets and services. Using our tax calculator, residents can quickly estimate annual obligations, including general, school, library, and purposes taxes. Timely payments prevent penalties and interest, while credits like owner-occupancy reduce liabilities. Staying informed about rates, due dates, and relief programs ensures homeowners in Hudson County make accurate financial decisions and plan their property expenses effectively.

FAQs

What is the average property tax rate in Hudson County?

The average effective property tax rate in Hudson County is approximately 2.12% for 2025, though it varies by municipality from around 1.10% in Hoboken to over 2% in Kearny.

When are property taxes due in Hudson County?

Property taxes are due quarterly on February 1, May 1, August 1, and November 1. A 10-day grace period is typically allowed before penalties and interest are applied.

How does the Hudson County property tax calculator work?

Enter your property’s market value, select your municipality and property type, and apply eligible credits. The calculator estimates assessed value, applicable tax rate, and the total annual property tax due.

What penalties apply for late property tax payments?

If taxes are unpaid after the 10-day grace period, interest accrues at 8% per annum on the first $1,500 and 18% on amounts above $1,500. Year-end penalties of 6% apply for delinquencies over $10,000.

Are there any credits available for Hudson County property owners?

Yes. Eligible residents can apply for the Owner-Occupancy Credit (2%) or Homestead exemptions, which reduce the assessed property tax liability and lower the overall annual tax bill.